Bhubaneswar’s New Middle Class: Aspirations Rising, Budgets Sinking

By | Sashi Sekhar Samanta|

Bhubaneswar, once a quiet administrative town, has transformed into one of India’s fastest-growing Tier-II cities. IT parks, smart-city corridors, premium schools, branded retail, and a booming real-estate market have redrawn both its skyline and its social fabric. At the centre of this transformation stands a powerful yet pressured group—the new middle class. Ambitious, educated, digitally connected, and eager to climb the ladder of modern living, they embody the city’s energy. Yet behind the excitement lies a quieter truth: their aspirations are rising far faster than their incomes, and the mismatch is becoming unsustainable.

The Aspiration Boom: The markers of middle-class ambition are visible everywhere. Families that once dreamt of a two-bedroom home now aim for gated communities with gyms, landscaped lawns, and clubhouses. Two-wheelers have become stepping stones to SUVs. Children are enrolled in premium international schools. Weekend visits to malls, cafés, and multiplexes have replaced modest outings. Festive shopping now begins with EMIs rather than savings. The city itself encourages this shift. Bhubaneswar markets its “smart city” identity through lifestyle infrastructure—metros in planning, wide roads, integrated public spaces, small IT clusters, and a globalized service economy. To the new middle class, this environment signals progress, and with progress comes the desire to fit in, to participate, to be seen as upwardly mobile. But aspiration has a cost, and the bill is rising.

Stagnant Salaries, Rising Prices : Incomes in Bhubaneswar, especially for mid-career professionals, have not kept pace with inflation or lifestyle demands. The service sector, which employs a large chunk of the city’s workforce, grows fast in numbers but slow in wages. Public-sector employees, long considered financially stable, now struggle to match the purchasing power of private professionals in metro cities. Housing is the sharpest pain point. Over the last decade, property prices in key zones—Patia, Khandagiri, Chandrasekharpur, and the new AIIMS corridor—have grown at a pace that outstrips salary hikes. Middle-class families are increasingly dependent on home loans that stretch over 20 to 25 years, consuming nearly 40–50% of monthly income. Renters face a similar squeeze, with urban pockets becoming unaffordable for even double-income households. Daily living costs have soared as well. Fuel, electricity, school fees, groceries, health care, and digital bills form a monthly expenditure graph that never stops climbing. Many families report that their salaries run out by the third week of every month—an indicator of how thin financial margins have become.

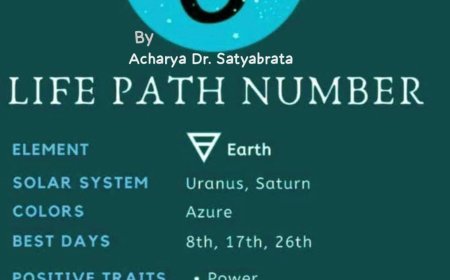

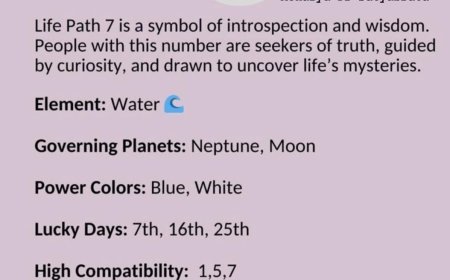

The EMI Lifestyle Trap : Much of the middle class’s sense of prosperity is built on credit, not income. EMIs have become the silent architecture of urban life. Home loans, car loans, education loans, credit card instalments, consumer durable EMIs—Bhubaneswar’s new middle class is trapped in a cycle of paying for a life they have not yet fully earned. This dependence on credit creates a fragile sense of well-being. Any unexpected crisis—medical emergencies, job loss, family responsibilities—can topple financial stability within months. The façade of prosperity hides a deep anxiety: Are we truly progressing, or are we borrowing our progress from the future?

The Pressure to Belong : A significant part of the middle-class squeeze comes from social comparison. The psychological pressure to “keep up” with peers is stronger in aspirational cities like Bhubaneswar. Social media fuels this race, with curated lifestyles creating an illusion of universal success. Families feel compelled to match the standards they see around them: children in elite schools , vacations outside the state or abroad , branded clothes and gadgets, dining out regularly , high-end housing , cars as status markers. This culture creates invisible expectations. Middle-class parents especially feel guilty if they cannot offer these experiences to their children, even when such choices stretch their budgets dangerously thin. In effect, aspiration becomes obligation.

The Illusion of Prosperity : On paper, the middle class appears comfortable—good jobs, modern lifestyles, digital conveniences, and better infrastructure. But the comfort is surface-level. In reality, they operate in a constant trade-off: sacrificing savings to maintain lifestyle, postponing health check-ups due to cost, delaying buying a second home, and cutting down on emergency funds. The illusion of prosperity is strongest in urban housing. A family living in a beautiful apartment may look wealthy, but the majority of that apartment belongs to the bank. Similarly, owning a car may symbolize status, but the EMI and maintenance often exceed the household’s real buying power. This mismatch between perception and reality leads to a dangerous outcome: the new middle class is prosperous only in appearance, not in stability.

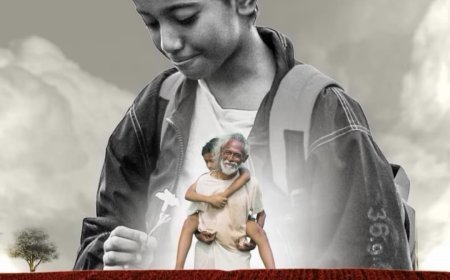

The Mental and Emotional Cost : The financial strain is accompanied by psychological stress. Dual-income households juggle demanding jobs and equally demanding expenses. Couples delay marriage or parenthood because they “aren’t financially ready.” Many young professionals feel they are working harder but progressing slower compared to previous generations.There is also a new form of socio-economic loneliness. Families that migrate to Bhubaneswar for opportunities often lack extended support systems. With higher costs and fewer social backups, they become vulnerable to burnout, debt, and emotional fatigue.

Where the City Must Intervene: The widening gap between aspiration and affordability is not just a personal challenge; it is a policy challenge. Bhubaneswar’s development model must evolve to protect its middle class from slipping into invisible distress.

What the city needs:mAffordable Housing Policies, More mid-range housing projects, reduced registration charges, and incentives for rental housing.mTransparent Education Costs, Regulations on private school fees to prevent excessive annual hikes. Reliable Public Transport, To reduce dependence on personal vehicles and associated costs. Support for SMEs and Startups, To improve income growth across sectors. Financial Literacy Programs, Enabling families to manage credit, plan investments, and build savings. Urban Cost-of-Living Monitoring, A dedicated index to track and address rising living expenses.

A Crossroads for the Middle Class:Bhubaneswar’s new middle class represents the city’s ambition, optimism, and energy. But if their financial reality continues to lag behind their dreams, this group may soon find itself disillusioned.The city’s progress must not come at the price of its people. Growth must be inclusive, opportunities must expand, and affordability must remain central to planning.For now, the new middle class lives between two worlds—one they aspire to, and one they can afford. Their story is not of failure, but of a city that is moving faster than the incomes of the people who built it.